- Rolling in Dough 💰

- Posts

- The Stock Behind Santa's Red Suit (& a Lot More Than Soda)

The Stock Behind Santa's Red Suit (& a Lot More Than Soda)

A familiar brand with a surprisingly durable business that makes for a good foundational stock.

Today’s Edition: The Stock Behind Santa’s Red Suit

Welcome back to another edition of "Rolling in Dough" Newsletter, where we serve up the simplest ways to save more, spend less, and build wealth with regular insights, behavioral science hacks, and tiny tips to do today. I hope to make your financial journey a little fun, simple, and totally doable, where ever you are on your wealth journey.

FROM OUR SPONSORS

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

Santa Claus is coming to town, and bringing a stock for you to consider.

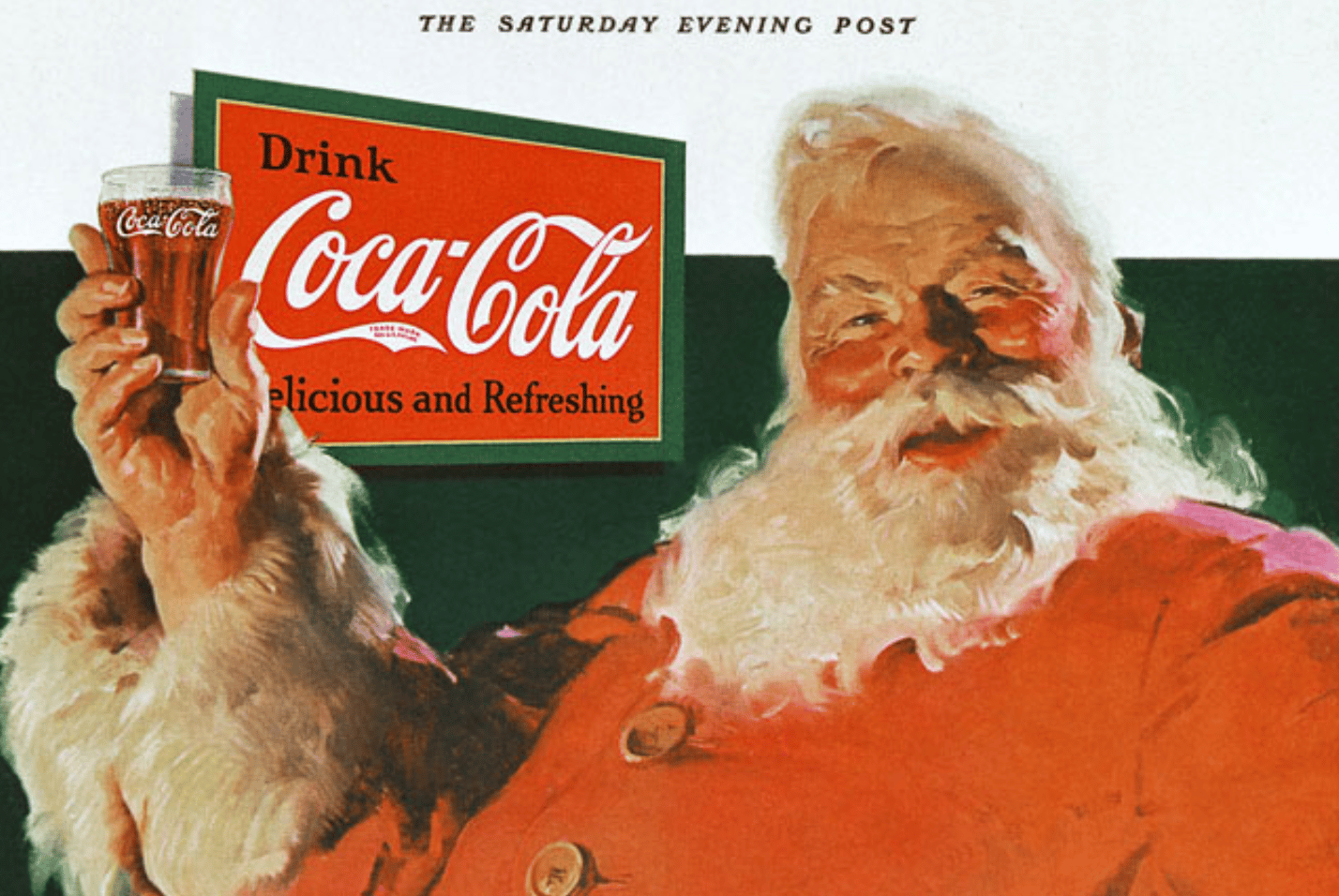

The original 1931 Coca-Cola ad, popularizing Santa’s look as we know it today

There’s a long-running rumor that Coca-Cola is the reason Santa wears red. Whether that’s true or not, the brand has been woven into pop culture for over a century, especially around the holidays.

And that familiarity isn’t just marketing. It’s part of why Coca-Cola is often discussed as a foundational stock.

What It Is

Have a Coke and a smile? A Coke and a … stock? Coca-Cola is a huge brand name that everyone knows. It sells over 200 beverage brands, including sodas, juices, teas, waters, sports drinks, and more.

Across all of those products, about 2.2 billion servings are consumed every single day around the world. That kind of scale is hard to replicate, and even harder to disrupt.

The company has been around since 1886, which means it’s survived world wars, recessions, inflation, changing tastes, and massive shifts in how people live and work.

Why People Use It

Coca-Cola operates in the non-alcoholic ready-to-drink beverage industry, an area that isn’t especially vulnerable to technological disruption.

People aren’t suddenly going to stop drinking beverages because of a new app or a breakthrough in AI. Habits change slowly, brands matter, and distribution matters even more.

That ‘boring’ nature helps create stability. Demand tends to hold up in good times and bad, which is one reason companies like Coca-Cola often feel steadier than trend-driven businesses.

One quiet strength of Coca-Cola’s business is its ability to adjust prices without losing customers.

During the third quarter, the company benefited from about 4% price growth, helping support revenue even as costs fluctuated.

When a company can raise prices modestly and still keep demand, it’s usually a sign of brand strength.

It’s Also Known for Dividends

Coca-Cola is also a Dividend King, meaning it has increased its dividend payout for 63 straight years.

Over just the past 10 years, its dividend has grown by roughly 46%. That consistency is a big reason the stock often shows up in income-focused portfolios.

The emphasis is on consistency, with a long track record of sharing profits with investors and steadily increasing those payments.

How This Fits Into a Bigger Picture

Coca-Cola is rarely something people buy for fast growth.

Instead, it’s often used as:

a steady, dividend-paying holding

a familiar anchor alongside growth investments

a way to add income from a company people understand

For beginners, it’s easy to grasp what the business does. For experienced investors, it can serve as a stabilizing piece in a broader mix.

FROM OUR SPONSORS

Pet insurance can help your dog (and your wallet)

Did you know 1 in 3 pets will need emergency treatment this year? Pet insurance helps cover those unexpected vet bills, so you can focus on care—not cost. View Money’s list of the Best Pet Insurance plans and protect your furry family member today.

A Few Things Worth Keeping in Mind

Like any stock, Coca-Cola isn’t perfect.

Growth tends to be slower compared to newer companies, and it may lag during periods when high-growth stocks dominate the market. It also operates in a competitive industry where consumer preferences can shift over time.

And like most dividend-paying stocks, dividends are taxable in a regular brokerage account, which matters depending on where you hold it.

These aren’t dealbreakers, just part of understanding what role the stock plays.

Many times, as people increasingly invest in technology stocks, this could be a great complement to that strategy.

👋 TO GO BITES: The Wrap Up

Coca-Cola is a well-known brand with global reach, steady demand, and a long history of paying and raising dividends.

That combination is why it’s often viewed as a foundational stock, not for chasing trends, but for adding stability and income over time.

As always, this isn’t personal investment advice. Everyone’s situation is different, and what makes sense depends on your goals and timeline. Talking with a financial professional can help you decide how something like this fits into your bigger picture.

But if you’re looking at long-lasting businesses that have quietly rewarded investors for decades, Coca-Cola is one many people take a closer look at.

FROM OUR SPONSORS

What investment is rudimentary for billionaires but ‘revolutionary’ for 70,571+ investors entering 2026?

Imagine this. You open your phone to an alert. It says, “you spent $236,000,000 more this month than you did last month.”

If you were the top bidder at Sotheby’s fall auctions, it could be reality.

Sounds crazy, right? But when the ultra-wealthy spend staggering amounts on blue-chip art, it’s not just for decoration.

The scarcity of these treasured artworks has helped drive their prices, in exceptional cases, to thin-air heights, without moving in lockstep with other asset classes.

The contemporary and post war segments have even outpaced the S&P 500 overall since 1995.*

Now, over 70,000 people have invested $1.2 billion+ across 500 iconic artworks featuring Banksy, Basquiat, Picasso, and more.

How? You don’t need Medici money to invest in multimillion dollar artworks with Masterworks.

Thousands of members have gotten annualized net returns like 14.6%, 17.6%, and 17.8% from 26 sales to date.

*Based on Masterworks data. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

—

Stay tuned for more mini tips and tricks to help you spend less, save more, and build the life you love, one smart move at a time. The ultimate goal: to be rolling in dough.

👋 Happy Holidays to you,

Rooting for you. Let’s make this dough grow!

Profit Nic

Not legal, tax, or investment advice. For general educational purposes only. Lotsss of simple ways to save more, spend less, and build wealth. You are absolutely amazing.